Seeking a successful path to core modernization

Seeking a

successful

path to core

modernization

Modern banking is a far cry from the analog processes of yesteryear. Today’s smartphone-wielding customers demand hyper-personalized transactions woven seamlessly into everyday life,

one-to-one personal service with their data at agents’ fingertips, and instantaneous financial insights—and some are even pressing for features like blockchain integration and support

for digital currencies. But the ability to serve these customers is not assured: Gartner predicts that by 2025 more than 85% of organizations will move forward with cloud principles,

but will not yet be able to fully use cloud-native architectures and technologies.

These tools will be key to banks’ ability to move to digital ecosystem platforms and develop new services,

partner with other players, work effectively with colleagues, and meet customer expectations.

Financial institutions are under pressure to future-proof and accommodate emerging technologies such as artificial intelligence (AI), machine learning (ML),

and cloud computing—and they are also facing significant infrastructural strains. Whereas some banks of all sizes still operate with a siloed, monolithic system,

they will face increasing difficulty meeting the demands of a large customer base and a slew of interconnected digital services. A 2023 study by research firm

IDC and payment software company Episode Six projects that using outdated technology

cost banks more than $36 billion in 2022, and could cost banks more than $57 billion by 2028. Governance issues, vendor lock-in, staff turnover, and limited resources are compounding

stressors on legacy systems.

“The phrase ‘core banking system’ has changed dramatically over the past 50 years,” says Dave Murphy, head of financial services for Europe,

Middle East and Africa and Asia Pacific at Publicis Sapient, a global digital transformation consulting company. The dramatic changes in core

banking systems has changed how banks approach banking, which changes how they should tackle modernization. “When people think about modernizing a

core banking system, they’re trying to break down the problem that was created decades ago when it was the entire bank in a single system,” he says.

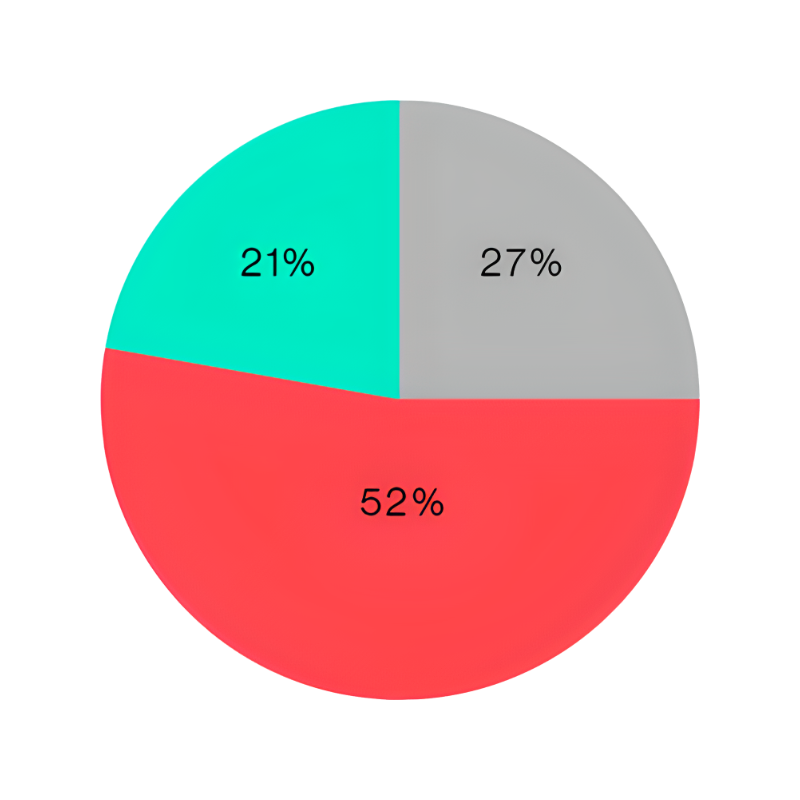

Fewer than one-third of the world’s biggest banks are investing in digital financial ecosystems

in a “meaningful way,” according to 2023 research from the Boston Consulting Group. The same research says about 25% of these organizations are investing

in pilot testing core banking systems.

27% Significant engagement: The digital ecosystem is strongly linked to the core business.

52% Moderate engagement: The ecosystem is partially linked to the bank’s core business.

21% Minimal engagement: The digital ecosystem is primarily linked to pilots.

At least in theory, migrating to a modern core can ameliorate all of these issues. But executives and compliance teams are apprehensive about the risk and effort involved.

To successfully clear these hurdles, Murphy says, it’s critical to take end-to-end strategic steps—including embracing core tenets of the “composable enterprise” and

exploring migration tactics such as purposeful coexistence.

To innovate and address limitations of legacy infrastructure, there are some situations when modernization is compulsory—for instance,

when resilience issues can’t be remedied by additional hardware or when a vendor goes out of business, resulting in an imminent end-of-life scenario.

Even in less-drastic circumstances, legacy systems leave much to be desired. Financial institutions have become larger and more sprawling

through acquisitions and customer growth during the past several decades, meaning ingrained monolithic technologies are supporting much more

than they were originally designed for. Operating on these antiquated systems, banks often have difficulty responding to market shifts like

interest rate changes or demand for new products such as buy-now-pay-later (BNPL) applications. Governance issues, too, are a growing concern,

as regulatory compliance necessitates nimble systems that can easily adapt to changing laws and standards.

What’s more, the aging nature of legacy systems poses personnel challenges. Murphy notes that there’s a shrinking pool of experts familiar with older banking technologies.

“There are significant skills and knowledge gaps,” he says. “A lot of these systems were created a long time ago, and frankly, people are not learning those back-end technologies—things

like COBOL or Assembly—these days.” Developed in the late 1950s, COBOL plays a foundational (and a growing) role in banking systems, according to a 2022 survey of enterprise users by

market researcher Micro Focus: 92% of respondents said COBOL is strategic for their enterprise, and more than half expect to still be using it in 10 years.

59% Legacy infrastructure

53% Lack of real-time access to data

51% Lack of agility

47% Ineffective data strategies

44% Finding the right partners

39% Compliance challenges

38% Lack of digital experience

These challenges are compelling reasons to pursue core modernization. But some approaches like “big bang” migrations, in which an organization switches

to a new system all at once, have proven disastrous time and time again. In part because of debacles like the UK’s

TSB Bank system transition in 2018—during which

customers were locked out of their accounts, confidentiality was compromised, and funds were misappropriated—this migration tactic has become

synonymous with service disruptions, failures, and regulatory penalties.

A big bang method, Murphy says, “definitely has become an unfeasible approach, primarily because I think there’s been enough case examples of disasters created

by it,” explains Murphy. On paper, he says, it may appear faster and therefore less expensive. But the track record of big bang transformations

like TSB Bank has drawn attention to the need for coexistence between old and new systems for a longer period of time, he says.

“People are now requesting more of an incremental migration,” Murphy says.

An incremental approach is only feasible when financial institutions have a supporting framework in place.

This is where the concept of the composable enterprise comes into play. Gartner defines a composable business as infrastructure

made from interchangeable building blocks, which permits agility in response to new demands, traffic spikes, production issues, or supply chain challenges.

Becoming composable involves deconstructing massive, unwieldy systems into more flexible, modular parts, effecting not just a bank’s technology structure,

but its operating model. This approach not only frees the backend, but also facilitates collaboration across a broader spectrum of solution providers.

Putting data at the core, it ensures a more seamless user experience as banks experiment with modernizing services in a more piecemeal fashion.

“You want to limit the change that a customer sees when you’re modernizing your architecture,” explains Murphy. “Fundamentally, if you’re

providing them with the same service but forcing them to change their behaviors because you’ve changed systems, that can be quite difficult to manage.”

Further, modularity can be a springboard for innovation, allowing institutions to upgrade components like customer identification or fraud detection

without a comprehensive overhaul, Murphy says. It also lets banks test and learn from small portions of their customer or product portfolio,

unlocking potential growth opportunities.

These growth opportunities emerge, in large part, from better use of data. A 2023 survey of U.S. banking leaders by Forbes and banking software company Thought Machine found

respondents (63%) consider their customer data

a significant competitive advantage.

“One of your greatest assets as a bank is the data—ownership, being able to access it, leverage it in real-time, and apply it to innovative areas like AI,” says Murphy.

“So, you need to free yourself up so you actually have ownership of your data and access to it. Then, you can begin to compose a set of solutions for your customers around it.”

“One of your greatest assets as a bank is the data—ownership, being able to access it, leverage it in real-time, and apply it to innovative areas like AI.”

Dave Murphy, Head of Financial Services for Europe, Middle East and Africa and Asia Pacific, Publicis Sapient

Alongside composability, a strategy of purposeful coexistence

plays a central role in an effective core modernization journey. This transitional tactic involves running old and new core systems concurrently,

resulting in less risk, and leading to a more phased, calculated, and strategic migration.

Murphy says this approach is complementary to the composable enterprise mindset. “It’s a whole lot harder to think about coexistence if

you’re not thinking about your institution or bank as a composable enterprise. If you’re moving from one monolith to another,

you’re effectively moving from two black boxes, which is very difficult,” he notes.

Recent research by Publicis Sapient

on core banking transformation points out that separating migration and coexistence strategies can help ensure each is executed with focus and

expertise. Other factors that might boost success rates include implementing a common data layer for efficient aggregation, a routing layer for

optimized data distribution, and strategic “hollowing out of the core” to provide modules for both legacy and new systems.

The research emphasizes the significance of automated reconciliation using advanced technologies for streamlined data integration, in-depth analysis

of legacy data to make informed migration decisions, and testing coexistence strategies in a live environment for early risk mitigation. Planning for

the decommissioning of the older system is also essential to realize cost savings and ensure stakeholder commitment throughout the modernization process.

Embrace coexistence and empower a central team. This team needs senior sponsorship, and the ability to make difficult decisions at pace.

Don’t try to answer all questions at the start. Let the central team set a north star early on, lay the implementation path, and work through each challenge.

Use technology to better support coexistence. Use the target architecture to enable coexistence, so interim builds can more easily be changed as you transition.

Identify your coexistence control points. The fewer points you must control to flip from one coexistence state to another, the better.

Tactically invest in legacy. Plan these changes early with the teams supporting the legacy core, including third parties.

Separate migration and coexistence. Data migration is moving data from A to B. Coexistence is a state the bank will operate for several weeks to several years.

Build a common data layer. A common data layer aggregates data and feeds downstream systems, minimizing downstream impact.

Create a routing layer. A data cache solution allows the routing layer to make efficient and transparent routing decisions.

Consider domains and capabilities. Build critical enabler domains—like customer or payment—to ensure they are already disaggregated.

Invest in automated reconciliation. The need to reconcile data sources will materially increase during coexistence.

Go deep on the coexistence data analysis. Don’t run on assumptions about the core legacy data and which coexistence states you need to cater for.

Test and prove coexistence in production early. There may be an opportunity to de-risk any cutover to a coexistence state.

Plan for decommissioning of the legacy estate early. Ensure the cost savings for the program is understood, tracked, and happens as early as possible.

Purposeful coexistence can set a strong foundation for digital transformation efforts including core modernization.

“The goal with purposeful coexistence is to minimize the changes that downstream reporting and general ledger systems see—and to really

keep it focused on incremental improvements between those two layers,” explains Murphy. “Though you have to be very smart about it,

it’s frankly the only move banks can make today, given our 24/7 connected world and its enormous demands.”

“Though you have to be very smart about it, it’s frankly the only move banks can make today, given our 24/7 connected world and its enormous demands.”

Dave Murphy, Head of Financial Services for Europe, Middle East and Africa and Asia Pacific, Publicis Sapient

Bank leadership are obliged to think about the strategic outcomes, Murphy says. Modernization can mean banks are ready for fundamental market-level innovations,

and developments like generative AI. “One outcome is the confidence that you truly have a resilient architecture that can continue to respond to the enormous

demands customers are putting on your bank, that you frankly never had before,” he says. “Resilience may not drive top line growth, but it will allow you to

stay in business,” Murphy says.