Is the digital dollar dead?

And a digital dollar is looking less likely every day.

It’s about cash

Opponents of the hypothetical US CBDC see it as a solution in search of a problem. After all, dollars are already digital. If you paid with a debit card recently, did you pay with digital dollars? They argue that China’s move to pilot a central bank consumer digital currency is not a justification for its creation. Libra failed to launch; a global digital currency run by a tech company is no longer an issue. What purpose could a government-issued digital currency serve other than to provide the government with a tool for financial surveillance and control?

But there is a problem, which you yourself have probably noticed. Physical money is leaving. Fewer and fewer vendors accept bills and coins. In addition, consumers simply choose to use less money. This is partly for convenience, but there’s another big reason: you can’t use cash to buy things online.

In the US, cash payments accounted for just 18% of all payments in 2022, down from 31% in 2016, according to a study by the San Francisco Fed. Outside the US, the road to a cashless society is still further along. The reduction of cash is the main reason that more than 100 countries are exploring the idea of creating their own digital currencies.

The solution is a digital currency with all the characteristics of physical cash, according to Willamette University law professor Rohan Gray.

The fact that we can’t use cash on Amazon is just one argument in favor of government-issued digital money, Gray says. In the US, many people rely on bills and coins because they don’t have bank accounts and can’t get credit or debit cards. The Federal Deposit Insurance Corporation estimates that 5.9 million US households will be unbanked in 2021. In addition, Gray argues, cash has unique “social features” that we must carefully preserve, including its privacy and anonymity. No one can track how you spend your coins and bills. “I think anonymity is a social good,” he says.

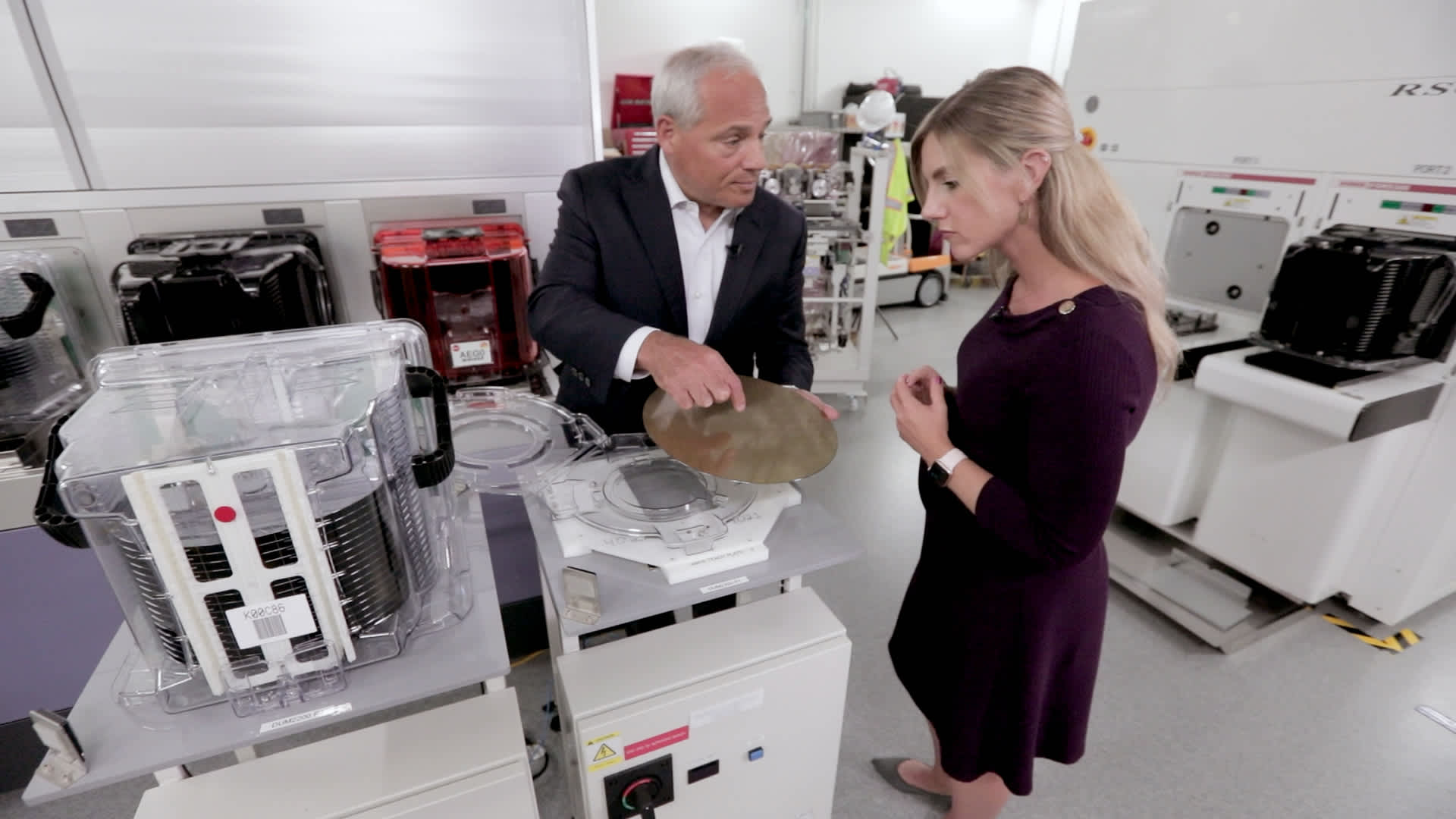

Last year, Gray helped draft a US House bill called the Electronic Currency and Secure Equipment (ECASH) Act. The legislation, which was introduced by Stephen Lynch of Massachusetts, directed the Treasury Department to create a digital dollar that could be used both online and offline and have features similar to cash, “including anonymity, privacy and minimal transactional data generation.” The Financial Services Committee has not come out, but Gray says there are plans to reopen it this year.

DeSantis and other CBDC opponents likely agree with Gray that we should replicate the privacy of cash in digital form — after all, they claim to protect Americans from the financial surveillance state. But while Gray favors a government-controlled system, they seem to prefer something more like decentralized cryptocurrency networks that are not controlled by any central authority.