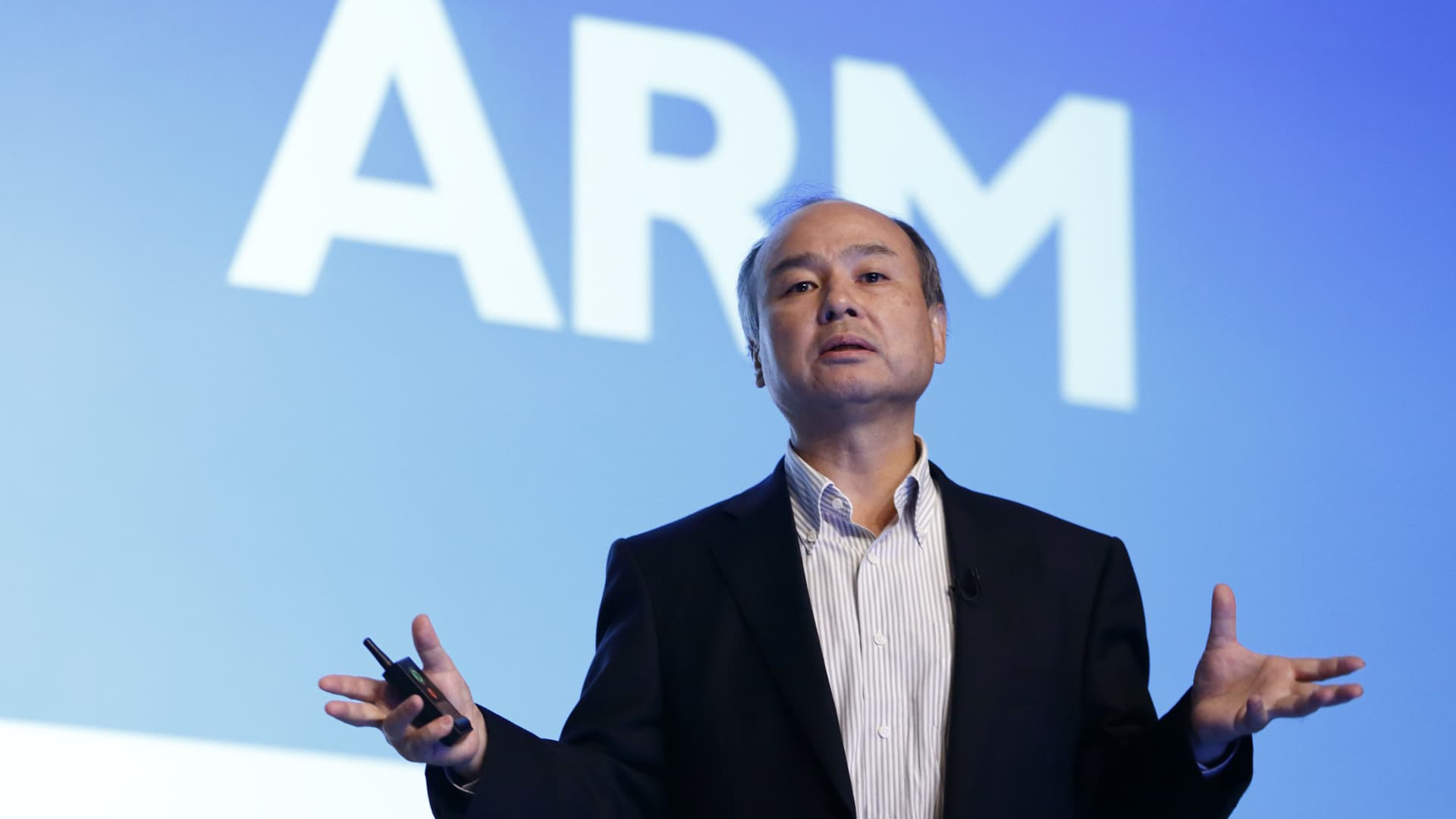

Arm China ‘doing well,’ CEO says, even as SoftBank’s Masa Son reduces China exposure

You can watch David Faber’s interview with Arm CEO Rene Haas and SoftBank CEO Masayoshi Son live on CNBC Pro.

Arm’s China subsidiary is “doing well” with strong potential in data center and automotive applications, despite the geopolitical tumult of the last few years, Arm Holdings CEO Rene Haas said in an interview with CNBC ahead of the company’s Thursday Nasdaq debut.

But SoftBank CEO Masayoshi Son, who made a fortune through Chinese juggernaut Alibaba, said SoftBank had reduced its “exposure in China” by a significant amount.

Complicating that statement, however, is Arm’s dependence on Chinese customers who, for now, are still able to purchase the company’s semiconductor technology and designs.

Neither Arm nor SoftBank, which acquired Arm for $32 billion in 2016, directly control their China subsidiaries. In 2018, SoftBank sold a controlling stake in the China business to a group of Chinese investors. Arm now only directly owns around 5% of Arm China, but the group still accounts for nearly a quarter of Arm’s fiscal 2023 revenue, according to pre-offering filings.

That relationship may face further pressures in the coming months. The Biden administration has continue to implement stringent export controls on high-powered semiconductors that can be used for artificial intelligence. The restrictions have already hit Intel and Nvidia, and while Arm doesn’t fabricate its own chips, it does sell designs to many chip companies.

The Biden administration has also introduced fresh outbound investment restrictions on key technology sectors.

Son was focused on SoftBank’s stake in Alibaba, which SoftBank has been reducing steadily over the last few years. “Most of the shares in Alibaba from SoftBank [are] already sold,” Son told CNBC’s David Faber in an interview.

The reduced exposure may have less to do with risks from China and more with SoftBank’s own portfolios. SoftBank has taken big losses on its Vision Fund I and II, although Vision Fund I is now back in the black. And one of the biggest prizes in its non-public portfolio, TikTok owner ByteDance, has been under pressure from the U.S. government related to data collection practices.